Dragons,

Looking at the 10 yr yield is key understanding market direction. When the 10yr drops, a great rotation is coming into growth stocks. Growth stocks are built on cheap debt. When the 10yr rises, that means rotation from growth to value is the next trade.

10 YR GIVES us hints about market forecast in terms of: debts and deficits.

When there is too much debt in the system, the country can never pay it off or the interest on top. Why do government cut interest rates? It’s cheaper to inflate assets so that they don’t feel obligated to pay their debts off.

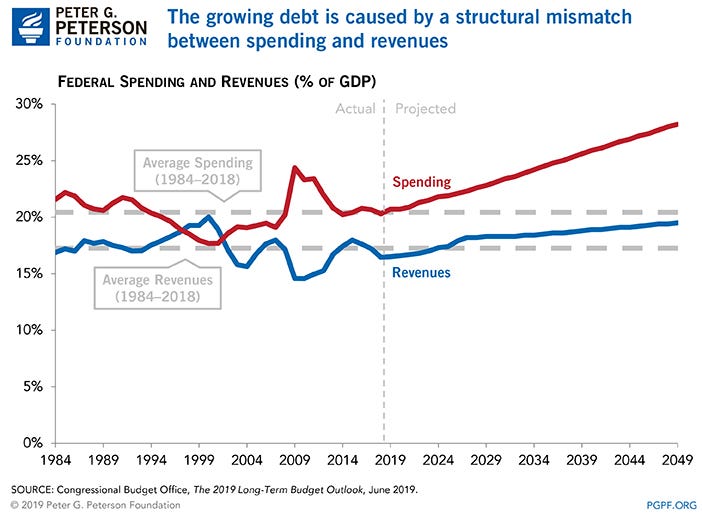

Above is a chart of GDP and spending. There’s a big difference when the government cannot collect the taxes it needs to offset the spending it is doing. An healthy debt to GDP ratio should be at least under 70%. If we look at the debt clock of the USA. We see that we are WAYYYY BEYOND THAT!

Why is this important?

You will pay more taxes!!!!! Inflation is TAX ON YOUR PURCHASING POWER. This picture below shows you that most of the debt is own by the public. All debt are in some form of bonds. A bond is IOU with a tiny bit of interest paid to the bond investor. There are many types of bonds from corporate, municipal bond, foreign bonds, and treasury bonds. The list can go on.

Here’s something to remember something important as well. The Federal Reserve is responsible for monetizing all the deb that federal government does IN EVERY STIMULUS BILL that gets passed in Congress. They will buy every toxic asset on the market and never tell the citizens of the tale of two balance sheets. The one you can see and the one you cannot see. The one you can see is on the Federal Reserve’s website The one you cannot see is the shadow banking system. They do not report how much they spend every week or night to prevent the reverse repo market from exploding.

Another thing to note is that the Federal Reserve has been actively buying mortgage backed securities. This has led a housing crisis and bubble out of epic appropriations.

There’s talk in congress about the debt ceiling and raising that debt ceiling right now.

Why do the representatives and senators want to raise this debt ceilings?

Remember, we talked about debts and deficit spending and the government is currently taking LESS TAXES it need to pay it’s bills. If they increase the debt ceiling, this will only incentive the government to keep spending more and borrowing more money. This is like asking the bank for a credit line increase and never having to prove that you make enough over the credit card at the end of the monthly billing cycle. So your drunk insolvent Uncle Sam is on it’s last line of credit.

Understanding Central Banking and Montery Policy is key to improving your trades. You can’t short this fake market where you think that the market is finally going to drop but the dips are getting BOUGHT! LITERALLY, THE FED IS THE MARKET!

What other factor affect market?

Crude Oil (USOIL (forex ticker), /CL (futures)) and the DOLLAR INDEX (DXY)

That’s another time I will explain.